When you make a purchase using the links on this site, I may earn a commission at no additional cost to you.

Table of Contents

Understanding Medicare Advisors Consultants, Brokers, and Agents

As individuals approach the age of 65, understanding the complexities of Medicare becomes crucial. Medicare Advisors, Medicare Insurance Brokers, and Medicare Insurance Agents are licensed insurance professionals specializing in guiding seniors through the Medicare landscape. These professionals are well-versed in various Medicare plans and can provide invaluable assistance in selecting the appropriate coverage.

Roles and Responsibilities

Medicare Advisors, Consultants, Brokers, and Agents offer a comprehensive range of services tailored to meet the unique needs of seniors:

- Plan Selection: These professionals help seniors understand their Medicare options, including Original Medicare (Part A and Part B), Medicare Advantage (Part C), and Prescription Drug Plans (Part D). They provide personalized recommendations based on individual health needs and financial circumstances.

- Supplemental Coverage Guidance: Advisors assist in evaluating and selecting supplemental coverage options like Medigap policies, which help cover costs not included in Original Medicare.

- Enrollment Assistance: Navigating the enrollment process can be challenging. Advisors ensure that seniors complete the necessary paperwork accurately and on time.

- Ongoing Support: Medicare needs can change over time. Advisors offer ongoing support to ensure that seniors’ coverage continues to meet their needs.

Are Medicare Advisors, Consultants, Brokers, and Agents the Same?

Yes, Medicare Advisors, Medicare Insurance Brokers, and Medicare Insurance Agents often refer to similar roles. They are licensed professionals who specialize in Medicare and provide expert guidance on selecting and enrolling in Medicare plans.

Compensation of Medicare Advisors, Consultants, Brokers, and Agents

These professionals typically receive compensation from insurance companies, meaning they do not charge fees to their clients. However, it is essential to note that the commission paid to an advisor, broker, or agent can vary depending on the insurance plan selected. Despite this, reputable advisors prioritize their clients’ best interests and strive to recommend the most suitable plans.

Selecting a Medicare Advisor, Consultant, Broker, or Agent

Choosing the right Medicare Advisor, Consultant, Broker, or Agent is a crucial decision. Here are some steps to help you make an informed choice:

- Research and Reviews: Begin by checking third-party independent reviews to gauge the reputation of potential advisors, brokers, or agents.

- Licensing and Experience: Ensure that the advisor is properly licensed and has significant experience in Medicare. A proven track record of helping seniors find the right plans is a positive indicator.

- Representation of Multiple Carriers: Opt for professionals who represent multiple insurance carriers (preferably 7-10 or more). This ensures that they can offer a variety of options and are not biased towards a single provider.

- Personalized Service: Look for advisors who offer personalized service and have a genuine interest in understanding and meeting your specific needs.

Why Is There a Growing Demand for Medicare Advisors, Brokers, and Agents?

The complexity of the Medicare system and the increasing number of seniors becoming eligible for Medicare have led to a surge in demand for these professionals. Navigating the myriad of plan options, understanding coverage details, and ensuring compliance with enrollment deadlines can be daunting without professional assistance.

Finding a Free Medicare Plan Advisor, Broker, or Agent Near You

pearlhaven.com is a valuable resource for seniors seeking licensed Medicare Advisors, Brokers, or Agents. Here’s why you should consider using Thomas Marchant:

- Comprehensive Plan Comparison: Thomas allows you to compare plans across 40+ of the nation’s largest insurance brands, helping you find the best coverage at the best price.

- Personalized Advice: Receive customized recommendations from experienced professionals who understand your unique health and financial situation.

- Free Service: Thomas’ services are entirely free, with no hidden fees or charges.

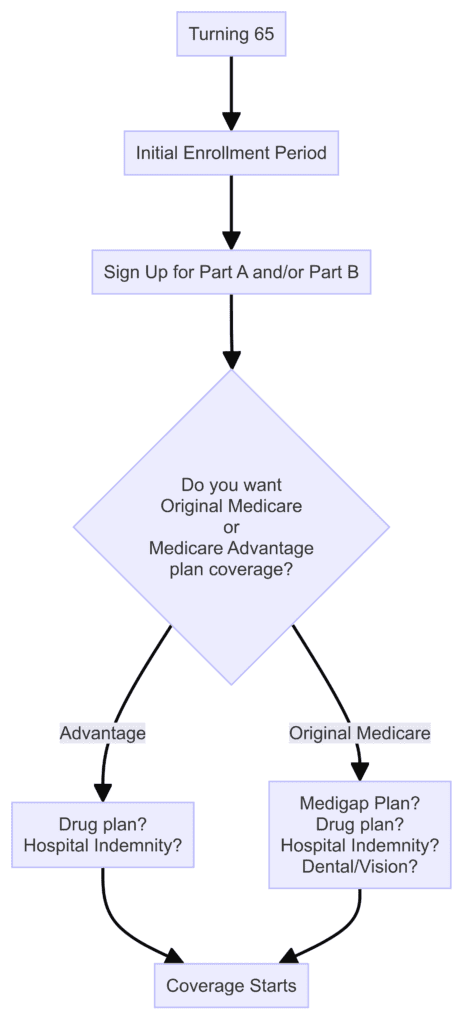

Recommended Diagram: The Medicare Enrollment Process

Below is a diagram to illustrate the Medicare enrollment process, which can be included to provide visual aid:

Conclusion

Navigating Medicare can be overwhelming, but with the help of a knowledgeable Medicare Advisor, Broker, or Agent, seniors can confidently select the right plan for their needs. By following the steps outlined above and utilizing resources like pearlhaven.com, you can ensure that you receive the best possible advice and coverage.

Commission disclosure: As an insurance agent, I may earn a commission from insurance companies when a policy is sold. When you click on links and make a purchase, this can result in me earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network, Walmart, Etsy, AliExpress and Amazon. As an Amazon Associate, I may earn commissions from qualifying purchases from Amazon. Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.