When you make a purchase using the links on this site, I may earn a commission at no additional cost to you.

Medicare Basics

Table of Contents

Medicare: What You Need to Know

I believe that the better educated you are about Medicare, the easier it will be for you to make the right decisions about your Medicare health insurance choices. That’s why I have created this resource section.

This Medicare information section is here to educate you about your insurance options and provide you with the resources you need to help you select the right plan for your unique needs.

If there’s anything you need or if you have any questions, please feel free to contact me. I am here to help.

Medicare Eligibility

Generally, you are eligible for Medicare if you or your spouse worked for at least 10 years in Medicare-covered employment and you are 65 years old and a citizen or permanent resident of the United States.

If you are not 65, you might also qualify for coverage if you have a disability or with End-Stage Renal disease (permanent kidney failure requiring dialysis or transplant).

Here are some simple guidelines. You can get Part A at age 65 without having to pay premiums if:

- You already get retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to get Social Security or Railroad retirement benefits but have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

If you are under 65, you can get Part A without having to pay premiums if:

- You have received Social Security or Railroad Retirement Board disability benefit for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While you don’t have to pay a premium for Part A if you meet one of those conditions, you must pay for Part B if you want it. It is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you don’t get any of the above payments, Medicare sends you a bill for your Part B premium every 3 months.

The Parts of Medicare

Medicare Part A (Hospital Insurance) – Most people don’t pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working. Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. Beneficiaries must meet certain conditions to get these benefits.

Medicare Part B (Medical Insurance) – Most people pay a monthly premium for Part B. Medicare Part B (Medical Insurance) helps cover doctors’ services and outpatient care. It also covers some other medical services that Part A doesn’t cover, such as some of the services of physical and occupational therapists, and some home health care. Part B helps pay for these covered services and supplies when they are medically necessary.

Medicare Part C (Medicare Advantage) – Medicare Advantage is a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.

Medicare Part D (Prescription Drug Coverage) – Most people will pay a monthly premium for this coverage. On January 1, 2006, Medicare prescription drug coverage became available to everyone with Medicare. This coverage is to help you lower prescription drug costs and help protect against higher costs in the future. Medicare Prescription Drug Coverage is insurance. Private companies provide the coverage. Beneficiaries choose the drug plan and pay a monthly premium. If a beneficiary decides not to enroll in a drug plan when they are first eligible, they may pay a penalty if they choose to join later.

What to do During Your First Year with Medicare

Fill out an Authorization Form if you want your family or friends to call Medicare on your behalf. Medicare can’t give personal health information about you to anyone unless you give permission in writing first.

Make a “Welcome to Medicare” Preventive Visit appointment with your doctor during the first 12 months you have Medicare Part B. This free, one-time comprehensive “Welcome to Medicare” preventive visit puts you in control of your health and your Medicare from the start.

Sign up for MyMedicare.gov, the secure online service where you can access your personal Medicare information 24 hours a day, every day. You can:

- Track your health care claims

- View your “Medicare Summary Notices” (MSNs)

- Order a replacement Medicare card

- Check your Medicare Part B deductible status

- View your eligibility information

- Track your preventive services

- Find information about your Medicare health plan or Medicare Prescription Drug Plan (Part D), or search for a new one

- Keep your Medicare information in one convenient place

Learn what Medicare covers. You’ll get a list of tests, items, and services that are covered no matter where you live. If your test, item, or service isn’t listed, talk to your doctor or other healthcare provider about why you need certain tests, items, or services, and ask if Medicare will cover them.

Medicare-Related Enrollment Dates and Guidelines

September & October—Review and Compare Medicare Advantage Plans

- Review any notices from your plan about changes for next year. To learn more about your options download Medicare and You Handbook

Compare: In October, use Medicare’s tools to find a plan that meets your needs.

- This is the one time of year when ALL people with Medicare can make changes to their health and prescription drug plans for the next year.

Between: October 15- December 7

- Change from Original Medicare to a Medicare Advantage Plan.

- Change from a Medicare Advantage Plan back to Original Medicare.

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan.

- Switch from a Medicare Advantage Plan that doesn’t offer drug coverage to a Medicare Advantage Plan that offers drug coverage.

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesn’t offer drug coverage.

- Join a Medicare Prescription Drug Plan.

- Switch from one Medicare Prescription Drug Plan to another Medicare Prescription Drug Plan.

- Drop your Medicare prescription drug coverage completely.

January 1—Coverage Begins

- Your new coverage begins if you switched to a new plan. If you stay with the same plan, any changes to coverage, benefits, or costs for the new year will begin on January 1.

Between January 1–March 31

- If you’re in a Medicare Advantage Plan (like an HMO or PPO), you can make one change to a different plan or switch back to Original Medicare (and join a stand-alone Medicare Prescription Drug Plan) once during this time. Any changes you make will be effective the first of the month after the plan gets your request.

When to buy a Medicare Supplement policy

- The best time to buy a Medigap policy is during your Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month in which you turn 65 or older and have enrolled in Part B. (Some states have additional Open Enrollment Periods.) After this enrollment period, you may not be able to buy a Medigap policy. If you are able to buy one, it may cost more.

- If you delay in Part B because you have group health coverage based on your (or your spouse’s) current employment, your Medigap Open Enrollment Period won’t start until you sign up for Part B.

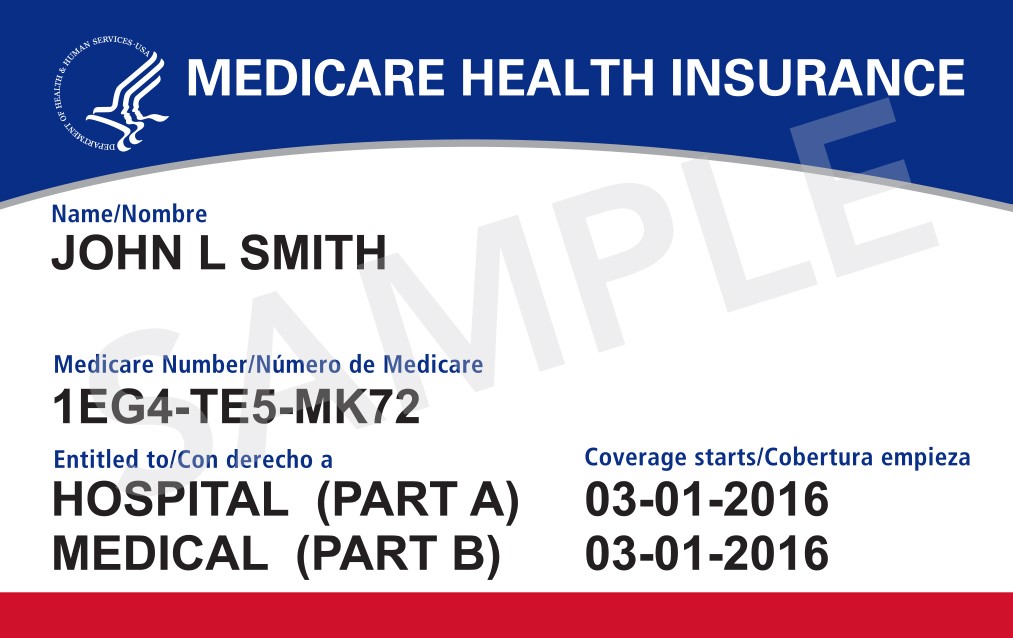

Five Things to Know About Your Medicare Card

Don’t forget to carry your Medicare card with you when you’re away from home. Let your doctor, hospital, or other health care provider see your card when you need hospital, medical or other health services. Here are five things to know about your Medicare card:

- Your card has a Medicare Number that’s unique to you, instead of your Social Security Number. This helps to protect your identity.

- Your card is paper, which is easier for many providers to use and copy.

- If you’re in a Medicare Advantage Plan (like an HMO or PPO), your Medicare Advantage Plan ID card is your main card for Medicare—you should still keep and use it whenever you need care. And, if you have a Medicare drug plan, be sure to keep that card as well. Even if you use one of these other cards, you also may be asked to show your Medicare card, so keep it with you.

- Only give your Medicare Number to doctors, pharmacists, other health care providers, your insurers, or people you trust to work with Medicare on your behalf.

- If you forget your card, you, your doctor or other health care provider may be able to look up your Medicare Number online.

This information came from www.medicare.gov

And, don’t forget to give me a call with your questions.

Commission disclosure: As an insurance agent, I may earn a commission from insurance companies when a policy is sold. When you click on links and make a purchase, this can result in me earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network, Walmart, Etsy, AliExpress and Amazon. As an Amazon Associate, I may earn commissions from qualifying purchases from Amazon. Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.