When you make a purchase using the links on this site, I may earn a commission at no additional cost to you.

Table of Contents

Introduction

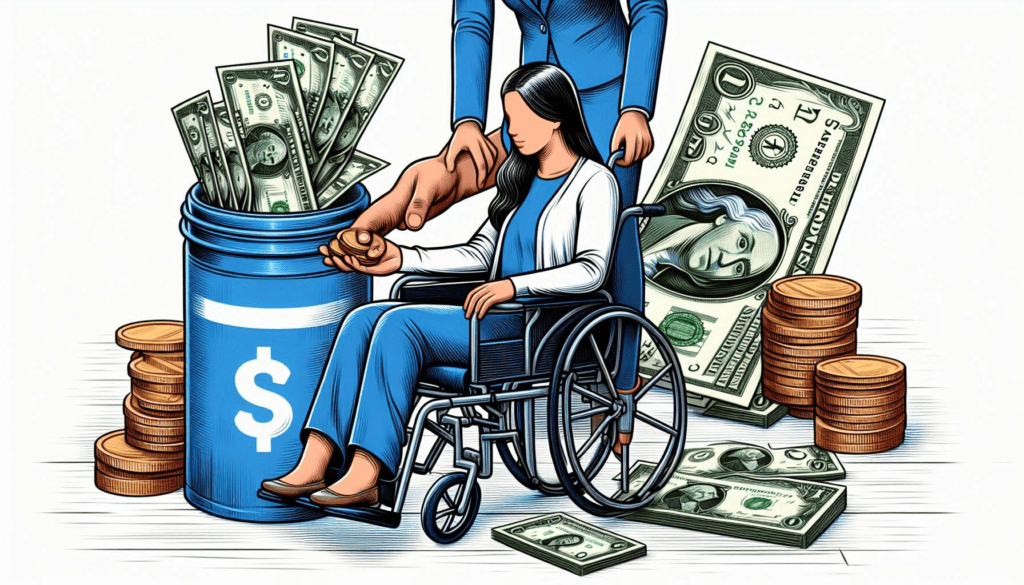

Disability Income Insurance (DI) is a crucial form of coverage that provides financial protection in the event you are unable to work due to a disability. Whether the disability is temporary or permanent, having this insurance ensures you can maintain your financial stability and continue supporting yourself and your family.

Understanding Disability Income Insurance

What is Disability Income Insurance?

Disability Income Insurance offers a safety net for individuals who lose their ability to work due to illness or injury. This type of insurance provides a portion of your income, helping you cover everyday expenses and maintain your standard of living during periods when you cannot earn a regular paycheck.

Key Elements of DI Policies

DI policies come with various features and benefits that you need to understand to make an informed decision. These include:

- Definition of Disability: Policies may differ in how they define disability. It’s important to know whether your policy covers only total disabilities or also includes partial or residual disabilities.

- Waiting Period: This is the period you must wait after becoming disabled before you can start receiving benefits. Typical waiting periods range from 30 to 90 days, but they can be longer.

- Benefit Period: The length of time you will receive benefits can vary. Short-term policies may provide benefits for a few months up to a year, while long-term policies can extend coverage for several years or until retirement age.

- Coverage Scope: DI insurance can cover disabilities arising from both accidents and illnesses. Ensure your policy provides comprehensive coverage that matches your risk profile.

The Importance of Disability Income Insurance

Supplementing Other Benefits

Many people assume that Social Security Disability Insurance (SSDI) or Workers’ Compensation will suffice in case of disability. However, these programs have significant limitations:

- Social Security Disability Insurance (SSDI): SSDI benefits are often limited and difficult to qualify for. The approval process can be lengthy and benefits may not cover all your needs.

- Workers’ Compensation: This only applies if you are injured on the job. Disabilities that occur outside of work, such as during recreational activities, are not covered.

Scenarios Where DI Insurance Proves Crucial

Consider these situations where DI insurance can be invaluable:

- Non-Work-Related Injuries: If you injure yourself playing a sport or during any non-work-related activity, Workers’ Compensation won’t help. DI insurance will step in to cover your income loss.

- Short-Term Disabilities: Even if you are temporarily disabled and expected to recover, the financial impact can be significant. DI insurance ensures you don’t deplete your savings or fall into debt during your recovery period.

- Long-Term Disabilities: For serious and long-lasting disabilities, DI insurance provides sustained financial support, helping you manage long-term expenses without compromising your financial future.

Advantages of Owning a Disability Income Insurance Policy

Financial Security

Your ability to earn an income is one of your greatest assets. DI insurance protects this asset, ensuring that an illness or injury doesn’t derail your financial plans. By replacing a portion of your lost income, it helps you cover essential expenses like mortgage payments, utilities, and groceries.

Portability and Customization

Individual DI insurance policies offer several advantages over employer-provided coverage:

- Portability: Unlike employer-provided policies, individual DI insurance stays with you even if you change jobs. This continuity of coverage is crucial for long-term financial planning.

- Customizable Coverage: You can tailor an individual DI policy to meet your specific needs. Choose the waiting period, benefit period, and coverage amount that best match your risk profile and financial goals.

Tax-Free Benefits

In many cases, the benefits received from an individual DI policy are tax-free. This means the income you receive during a disability period will not be reduced by taxes, allowing you to fully utilize the benefits for your financial needs.

Protecting Retirement Savings

Without DI insurance, you might be forced to dip into your retirement savings to cover living expenses during a disability. This can jeopardize your long-term financial security. DI insurance protects your retirement nest egg by providing a steady income stream, reducing the need to withdraw from savings prematurely.

Peace of Mind

Knowing you have a financial safety net in place provides peace of mind. You can focus on your recovery without the added stress of financial uncertainty. This mental and emotional assurance is an invaluable aspect of DI insurance.

Choosing the Right Policy

Evaluate Your Needs

Consider your current income, monthly expenses, and financial obligations when choosing a DI policy. Assess how much coverage you need to maintain your lifestyle and cover essential expenses if you were to become disabled.

Compare Policies

Not all DI policies are created equal. Compare different policies to find one that offers the best combination of coverage, benefits, and cost. Pay attention to the definitions of disability, waiting periods, benefit periods, and any exclusions or limitations.

Consult a Professional

Working with an experienced insurance broker can help you navigate the complexities of DI insurance. A professional can provide personalized advice and help you select a policy that aligns with your financial goals and risk tolerance.

Conclusion

Disability Income Insurance is an essential component of a comprehensive financial plan. It provides a reliable source of income during periods when you are unable to work due to a disability, ensuring that you and your family can maintain your standard of living. By understanding the key elements of DI policies and carefully choosing the right coverage, you can protect your financial future and achieve peace of mind.

Investing in DI insurance is a proactive step toward safeguarding your greatest asset—your ability to earn a living. Don’t wait until it’s too late; secure your financial well-being today with a robust disability income insurance policy.

Commission disclosure: As an insurance agent, I may earn a commission from insurance companies when a policy is sold. When you click on links and make a purchase, this can result in me earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network, Walmart, Etsy, AliExpress and Amazon. As an Amazon Associate, I may earn commissions from qualifying purchases from Amazon. Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.